The 2022 crypto market has endured a harsh correction amidst the wider global downturn in traditional equities and other assets. Rising interest rates intended to curb inflation have led investors to decrease their exposure to risk-on assets, including cryptocurrencies. Venture capital funding in those sectors has also cooled off, to some extent, except for Web3 gaming, which is proving to be a major contributor to the expansion of blockchain and cryptocurrencies around the world. There is plenty of data indicating that developers are still actively building in web3 gaming in 2022, despite the bear market. In fact, 2022 has been a huge year for development, investment and growth in both web3 gaming as well as NFTs, pointing to a productive crypto winter.

In this 2022 Web3 Gaming and NFT Market Report, we take a look back and summarize some of the key themes and metrics that mark the progress of these spaces. After a year of huge growth for cryptocurrency markets and increased attention on the web3 gaming space in particular, let’s see to see how these sectors coped with the market downturn, and how things are shaping up for next year.

Web3 Gaming

Crypto Market Overview

Given the harsh macro conditions pushing down all markets, the prices of Bitcoin, Ethereum and other altcoins have yet to recover from their steep corrections with any meaningful price action, even in Q4 of 2022.

Crypto game tokens were not immune to this downtrend, which led to a drop-off in profit-motivated players. This led some in the community to dismiss crypto gaming as a passing fad. However, notable investors such as Framework and a16z have continued to commit hundreds of millions in funding to develop new blockchain games, betting on a future in which blockchain gaming reaches mass adoption. In November 2022, despite the collapse of FTX, blockchain games raised a total of over $320 million (DappRadar).

This year, blockchain gaming activity has dropped 45% in terms of daily active users, from 755K on January 1st down to 421K as of Dec 15, 2022. Of all platforms, Wax was the most dominant gaming protocol with over 340,000 average daily unique active wallets. Meanwhile, Solana saw the biggest decrease in activity, dropping by 89.42% to an average of 2,326 daily unique active wallets (DappRadar).

Although this was a challenging year for crypto, it’s important to remember that the blockchain gaming space is still nascent, and there are plenty of reasons to believe that the future is bright and that it is still on track to become the main driver of Web3 adoption.

Web3 Gaming DAU 2022 (Source: Footprint Analytics)

Web3 Gaming Investments

This year, venture capital firms continued to invest heavily in Web3, particularly in the gaming and Metaverse categories. However, the total funds invested in these categories decreased from $5.5 billion in 2021 to $3.7 billion in 2022 (Footprint Analytics).

As of the date of this report, Animoca Brands leads the space with investments in 61 projects in the web3 gaming and Metaverse categories. They are followed by Infinity Ventures Crypto at 30 projects and Shima Capital at 29 (CoinMarketCap). The number of GameFi projects is still growing, albeit at a slower rate than previous years. Furthermore, Yat Siu, co-founder of Animoca Brands has also announced plans to start a $2 billion metaverse fund called Animoca Capital. The firm plans to make its first investment next year (Coindesk).

Most notably in September, independent game studio Theorycraft received the month's largest investment with a $50 million B round. With a founding team of names from Blizzard, Riot Games, and Ubisoft, the trend of established gaming companies and developers entering the Web3 space is undeniable (Cryptoslate). In October, Horizon Blockchain Games, developer of the game Skyweaver also announced a raise of $40 million in a Series A funding round that involved Ubisoft and Take-Two Interactive (DappRadar). More recently, Fenix Games, a Web3 game publisher also raised $150 million to acquire, invest, and distribute blockchain games (DappRadar).

While market conditions in 2022 have been uncertain and challenging, it’s clear investors still remain optimistic about the future of the blockchain gaming industry.

Number of Web3 Gaming Projects by Investor 2022 (Source: Footprint Analytics)

Performance of Web3 Games on Ecosystems

While Axie Infinity and STEPN may have been the first to gain widespread popularity, they are no longer the dominant projects in the space. In terms of active users, Alien Worlds and Splinterlands are the current leaders, with Alien Worlds boasting 131K average active users and Splinterlands following close behind at 98K. These two games alone make up around 30% of the total number of active players in the web3 gaming space (Footprint Analytics).

When it comes to transactions, WAX and Hive are the top performers. Both of these blockchain platforms are reliant on the success of Alien Worlds and Splinterlands, which make up 54.55% and 99.85% of their total users respectively (Footprint Analytics). BNB, the third largest chain by gaming transactions and gamers, has yet to produce a notable title in the space.

Despite this, BNB Chain remains one of the most robust chains in the gaming ecosystem. In terms of the number of new projects and market share, BNB still dominates, with 299 new projects launching on the platform in 2022 alone (excluding December) and a 37% market share in terms of web3 gaming protocols (Footprint Analytics). Ethereum comes in second in terms of new projects and market share.

It's clear that the world of crypto gaming is constantly evolving, with new players emerging and older ones falling by the wayside. While Alien Worlds and Splinterlands may currently be the dominant forces, it remains to be seen what the future holds.

Number of New Projects by Chain 2022 (Source: Footprint Analytics)

Launchpads

Launchpads have played a crucial role in allowing retail investors to gain exposure to the exciting world of web3 gaming projects. They are essentially incubators that help innovative projects receive the visibility and support they need from the broader ecosystem.

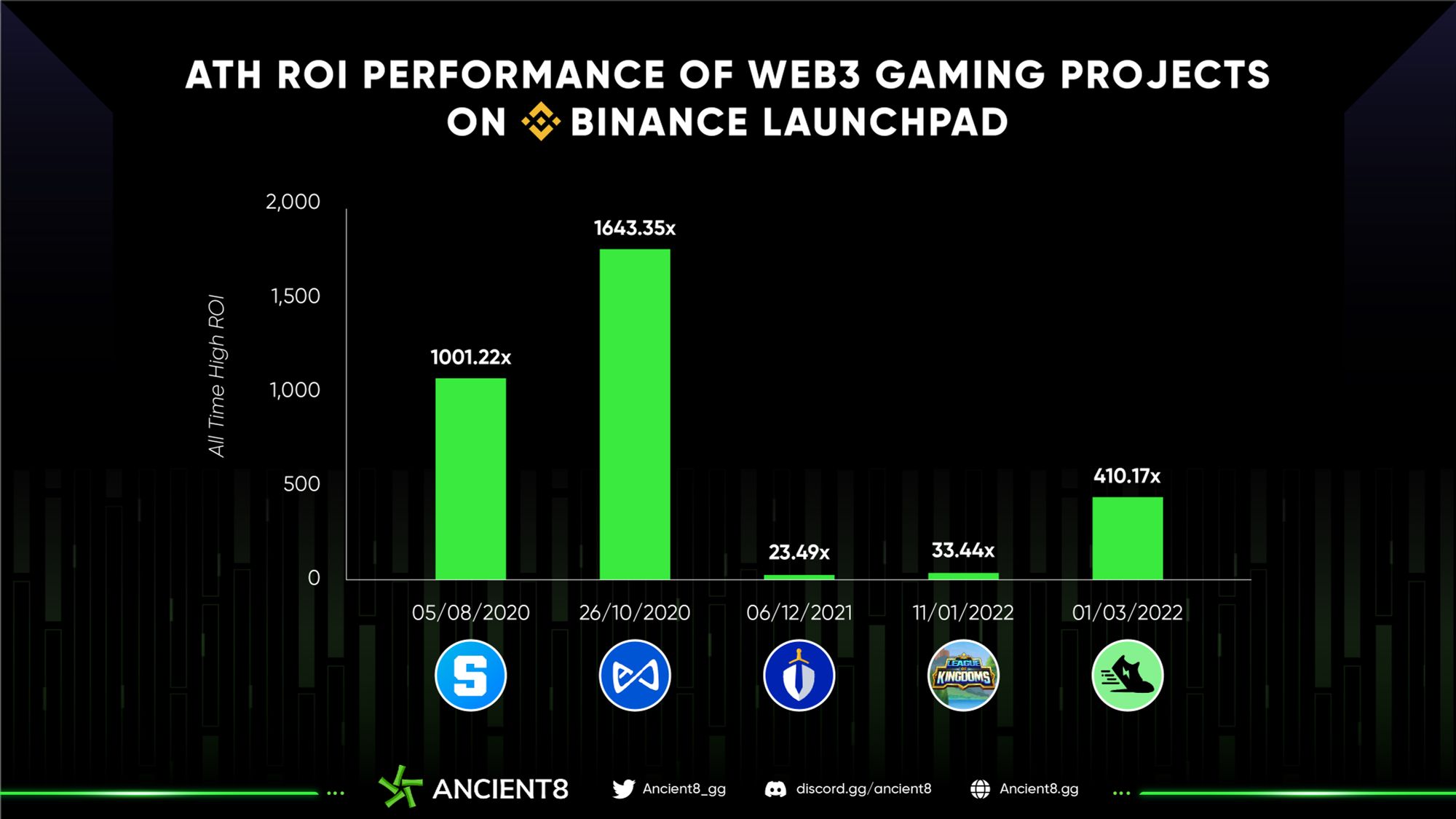

While there are many active launchpads in 2022, Binance Launchpad emerged as the leading exchange offering (IEO) platform, with a total of $132.9 million raised for 33 projects.

This year, there were only four project launches on the platform; however, two of them were web3 games: STEPN and League of Kingdoms. As of this report, investments in STEPN have yielded a staggering 30x return on investment (ROI), while League of Kingdoms yielded 2.4x ROI (CryptoRank).

Looking back, Q4 2021 was the peak period for web3 games on launchpads. In 2022, while all time high ROI’s reached an impressive 1467% across all platforms, the average current return has declined to -2.8% as of this report (Cryptorank). This figure can be heavily attributed to the fact that many of the games raising funds are still in early development. Furthermore, they are also affected by the price action of their underlying blockchain tokens (ETH, Solana, BNB, etc.). This highlights that while there is continued excitement around the Web3 gaming category, retail investors should be realistic about the timeline to profitability of these projects and their potential ROI.

All Time High ROI of Web3 Gaming Projects on Binance Launchpad (Source: CryptoRank)

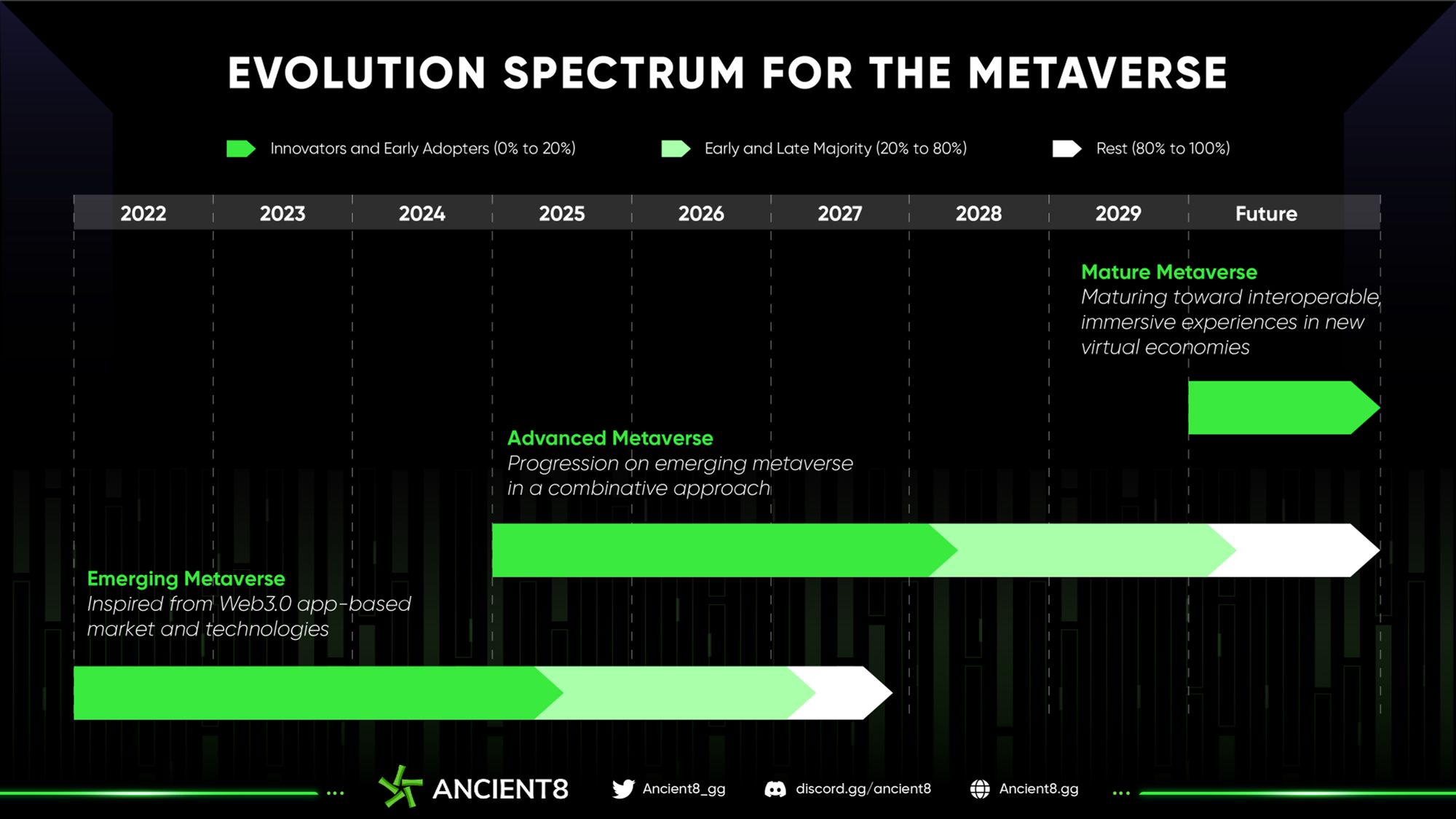

Emergence of Metaverse

The Metaverse, which is made up six underlying components including blockchain, interactivity, game, artificial intelligence, network and IOTs is trending more than ever. Gartner recently named the Metaverse one of the top five emerging trends and technologies for 2022 and even Goldman Sachs has predicted the potential Metaverse economy to be an $8 trillion opportunity (Bitcoin.com). Gaming plays a central role in the expansion of the Metaverse as gamers have traditionally already been joining immersive virtual experiences and fostering social connections.

Evolution Spectrum for the Metaverse (Source: Gartner)

2022 can be considered a fruitful year for the Metaverse investments as we saw not only leading web3 but also web2 institutions jump onto the Metaverse bandwagon.

- Microsoft’s announcement this year to acquire the gaming company Activision Blizzard, one of the key players in the gaming industry, was considered one of the biggest deals in the gaming and Metaverse space.

- The creator of Fortnite, Epic Games announced its equity valuation of $31.5 billion after securing $2 billion in funding from Sony and the owner of the Lego Group. The investment is designed to boost the Metaverse partnership Epic had formed with Lego to carve out their own space in these virtual worlds.

- Roblox, a combination of a game engine, development tools, and an online storefront for games, has become the biggest metaverse virtual world with 230 million monthly active users and accumulated over 11.8 billion hours worth of user engagement in Q1 2022. It is also one of the essential metaverse brand options in the market since many of the biggest companies in the world like Gucci, Nike, Walmart, Samsung, Tomy Hilfiger, etc have started to implement some form of presence in Roblox.

- SteamVR which is the ultimate instrument for the experience of virtual reality, obtained more than 5,000 apps available in Jan 2022. The figure further surpassed that of other big competitors like Oculus PC, Oculus Go, Oculus App Lab with 1,400; 1,150 and 837 apps available respectively (Statista).

Metaverse Competitive Landscape (Source: Influencer MarketingHub)

Though the Metaverse is still in its infancy, it is full of opportunities and constantly evolving. Once barriers to entry are lowered, and as underlying infrastructure matures, we can only expect new possibilities at the forefront of the digital frontier.

Innovative Trends and Tokens

- Free-to-Own: F2O is the strategy coined by Limit Break gaming studio’s whereby the studio mints a genesis NFT collection (DigiDaigaku in the case of Limit Break) and gives them away for free in an exclusive and secretive fashion. F2O lays the foundation for a new type of gaming economy, which is being proposed as an improvement on both free-to-play mobile games and the play-to-earn models that sell their game NFTs to players upfront. Whether F2O is fair or not, this model is one of the most promising we’ve seen in web3 gaming in 2022.

- Soulbound Tokens (SBT): SBTs are non-transferrable digital identity tokens that can represent the qualifications, experience, and/or reputation of a person or entity. These tokens take an innovative step towards representing and publicly verifying an individual’s reputation, achievements, and skill level, which will have wide-ranging implications for web3 games, guilds, players, etc. While SBTs are still a new concept, developers are already building SBT products that could be ready to use potentially by the end of this year.

- Permanent Death: This describes the playing process where a player’s character restarts from nothing upon death. As they progress in the game, the more battles they win, the more skilled their character becomes, and the more the owner gets rewarded. But if they lose, their character dies permanently, and the NFT representing it gets burned. The concept can help shift the focus of web3 gaming from playing for profit to playing for fun and embracing challenge as it encourages skill, tactics, and more calculated risk-taking.

- Physical Backed Tokens (PBT): This is an innovative open-sourced token standard tying a physical item to a digital token on the Ethereum blockchain introduced by Chiru Labs, the team behind Azuki, in October. PBT can be used for decentralized authentication of goods; Tracking ownership lineage of physical goods; Using physical products to create digital experiences. With PBT, holders now can build a collection that captures both the digital & physical, trade authenticated items, or participate in real-life quests.

- ERC-4907: Since the NFT rental platforms have gained popularity in the digital world, the ERC-4907 standard, proposed by Double Protocol, quickly became one of the most important token standards through its innovative and surprisingly simple implementation. Through its dual-role functionality, the ERC-4907 standard eliminates the need for collateral in lending and borrowing NFTs. If it is widely adopted as the standard for NFT creation and programming, it will unlock safer and more lucrative possibilities for NFT owners, buyers, marketplaces, and artists.

Remarkable Projects

- Illuvium: A collectible 3D fantasy RPG game that has established a strong and loyal following with 343k twitter followers. This year, in addition to closing a virtual land sale worth over $72 million, Illuvium has also recently released its first private beta of its auto-battler game mode. Boasting AAA graphics and gameplay, the reviews so far have bene overwhelmingly positive.

- Shrapnel: Featuring a BAFTA and Emmy award-winning team of veteran developers from franchises such as HALO and Call of Duty, the project has captured significant interest from the community, especially in the West. Having won “Most Anticipated Title” at this year’s Polkastarter GAM3 Awards, Shrapnel proves the quality of Web3 games will only be getting better.

- Big Time: An upcoming multiplayer action RPG currently in early access development. One thing this project has made clear this year is a focus on developing its in-game economy to become a “second-generation crypto game”. Recently, Big Time has just released comprehensive details about its economy and token, which aims to create a circular and sustainable player driven economy.

- Tatsumeeko: A multi-chain MMORPG built on the Tatsu.GG Gaming Bot in Discord that aims to “grow communities and strengthen worldly relationships”. The Tatsumeeko proof-of-concept reached 62K MAU, over 4.7M virtual goods traded, generating over $369K in micro-transactions. Tatsumeeko is already integrated into the popular Discord communities of PewDiePie, Davie504, Moistcr1tikal, Mobile Legends, Team Liquid, and the fan clubs of Kanye West, Ariana Grande, and Hololive Fan Server.

Outlook for 2023

Although it has been a turbulent year for the Web3 gaming industry, we are still in an incredibly early stage with massive potential in the long term. There are certainly areas where improvement is needed, but the industry continues to learn, evolve and innovate at a rapid pace. The paradigm-shifting advantage of ownership brought forth by Web3 cannot be overlooked. For this reason, we have seen an increased number of Web2 giants starting to adopt Web3, such as Ubisoft and Bandai Namco. This has been especially prevalent this year and we should only see more companies follow suit.

Despite macro challenges, the Web3 gaming industry persists and promises greater growth and new innovations in the near-mid term future. If any industry is capable of realizing the benefits of the blockchain and on-boarding the masses into Web3, it is gaming. We at Ancient8 remain excited to see where the future takes us.

NFT Space

Market Overview

Contrary to JPEG holders’ hopes for a prosperous year, the NFT market, in reality, was painted red, plunging 92% in market size. However, the retraction of the market was less a verdict on the utility of NFT, but rather a symptom of bad actors and market manipulators whose actions have halted the growth of the industry. Fundraising, as a result, took a nosedive from nearly $5 billion in Jan to only $610 million close to year-end (CryptoRank).

However, as they say: “pressure makes diamonds,” and there were many promising projects that rose from the ashes during the bear market and shed light on the future of unique digital assets.

This year, NFTs evolved beyond just an idle JPEG and welcomed exciting projects across segments including Azuki, Moonbirds, Skyweaver and DigiDaigaku. The rise of NFTs has also led to a proliferation of new marketplaces and platforms like X2Y2 and Blur.

This section of the report will provide a breakdown of the NFT market performance over the last year.

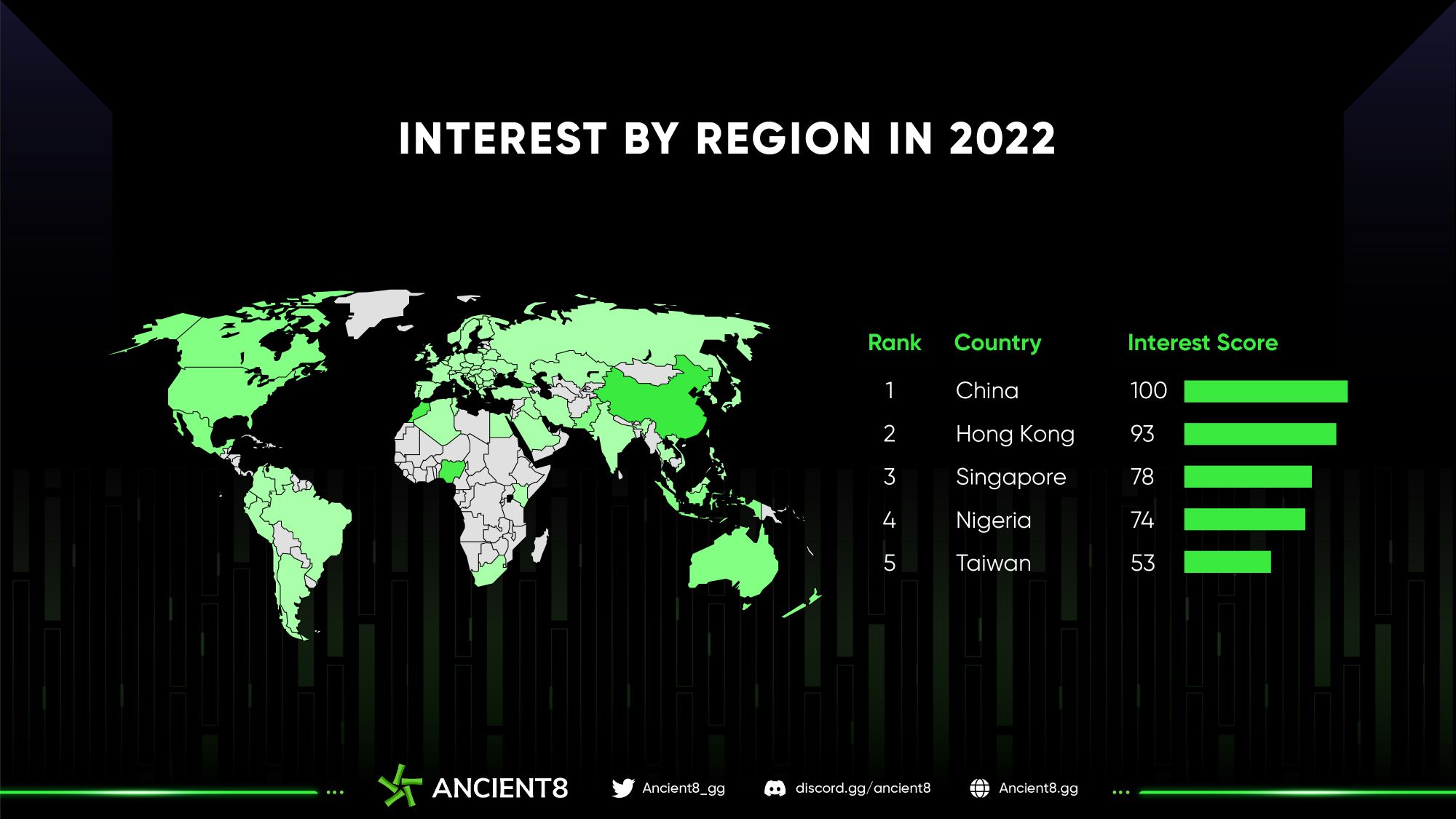

Search Volume

NFT search volume at the end of the year has tumbled ~90% from its peak in January, implying a cool-off in the interest in digital collectibles during a bear market.

NFT search volume is scored on a scale of 1-100 with 100 being the searched peak

NFT Interest by Region in 2022

Per the top five most-sought NFT regions above, four out of five are Asian countries and one in Africa. China had the most searches for “NFT” on Google. Interestingly, Bitcoin and other cryptocurrencies are banned in this billion-population country, so its citizens are turning their eyes to NFTs as an alternative investment. However, recent news suggests that NFTs are strictly regulated in China, and Chinese authorities prefer to call them “digital collectibles” with other big tech firms like Ant Group and Tencent following suit.

Performance by Segment

On a macro view, the weekly NFT sales volume of all segments had a solid performance in the first five months, with a yearly high in the first week of May with $1.8 billion in sales. This was due to a drop in cryptocurrency market prices earlier in the year, causing a shift in capital inflow in the NFT market for gaming, art and collectibles. Since then, the NFT market has slipped through the end of the year with no clear sign of recovery as the cryptocurrency market suffered a series of turbulent collapses by Terra, Celsius, 3AC and FTX in the midst of bearish macroeconomic headwinds. Also, the fear of a prolonged crypto winter and an anticipated financial downturn has made the market even more bleak.

NFT Weekly Sales by Segments (Source: NonFungible)

Over the past year, Collectibles have been the dominant segment in terms of volume of dollars traded, capturing roughly 70% of the market share. This can be attributed to the high levels of speculation in this category, including some notable names that brought NFTs to widespread popularity such as CryptoKitties, Bored Ape, and NBA Top Shot. PFPs are among the most sought-after collections as they are well recognizable on social media platforms like Twitter and serve as luxury digital goods to display social status.

The Metaverse sector had a humble performance during the year despite previously widespread anticipation of a breakthrough in virtual worlds. Otherdeeds for Otherside was the only collection that brought the heat in summer 2022, with a $1B spike in sales in May. Since then, the segment went mostly dormant during this winter phase with no significant movement.

NFT Weekly Trading Volume by Segment (Source: NonFungible)

Notably, 2022 saw a rise in the Utility segment thanks to high Ethereum Name Service (ENS) registrations during the 3 and 4-digit domains craze, reaching roughly 250,000 in trading volume at its peak in May. The affordable prices and low bear-market gas fees made ENS addresses one of the most attractive investments in the NFT sector.

The Game category, on the other hand, lost its dominant position in terms of sales volume, experiencing a 90% loss in market cap. A key factor that contributed to this fall was the $650M Ronin Bridge hack perpetrated against Axie Infinity, which is one the largest representatives in Web3 Gaming. This tragic event made some users lose confidence in the game, and the space.

Market Distribution by Project

As previously mentioned, the Collectible segment is leading the NFT industry; thus, the market is primarily dominated by Collectible projects. However, the space is highly centralized around the NFT powerhouse Yuga Labs, who owns six of the most prominent projects: Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Meebits, Otherside Otherdeeds, and CryptoPunks after its acquisition on March 11. Those projects are dominating the top 12 leaderboards, accounting for nearly a quarter of the market share.

Top NFT Projects by Trading Volume in 2022

This year also saw a rise of a rockstar project, Azuki, which sparked a new wave of interest in the space and gained massive global attention. This anime-inspired project aims to be the biggest Web3 brand in the world. Despite some major controversies, Azuki could still prove itself worthwhile by shipping innovative features and committing to its vision. Azuki ranks fourth overall in terms of the trading volume. Another notable project is Moonbirds, which despite having launched late compared to its peers, has made a significant impression in the market and risen quickly to join the top six best-performing projects.

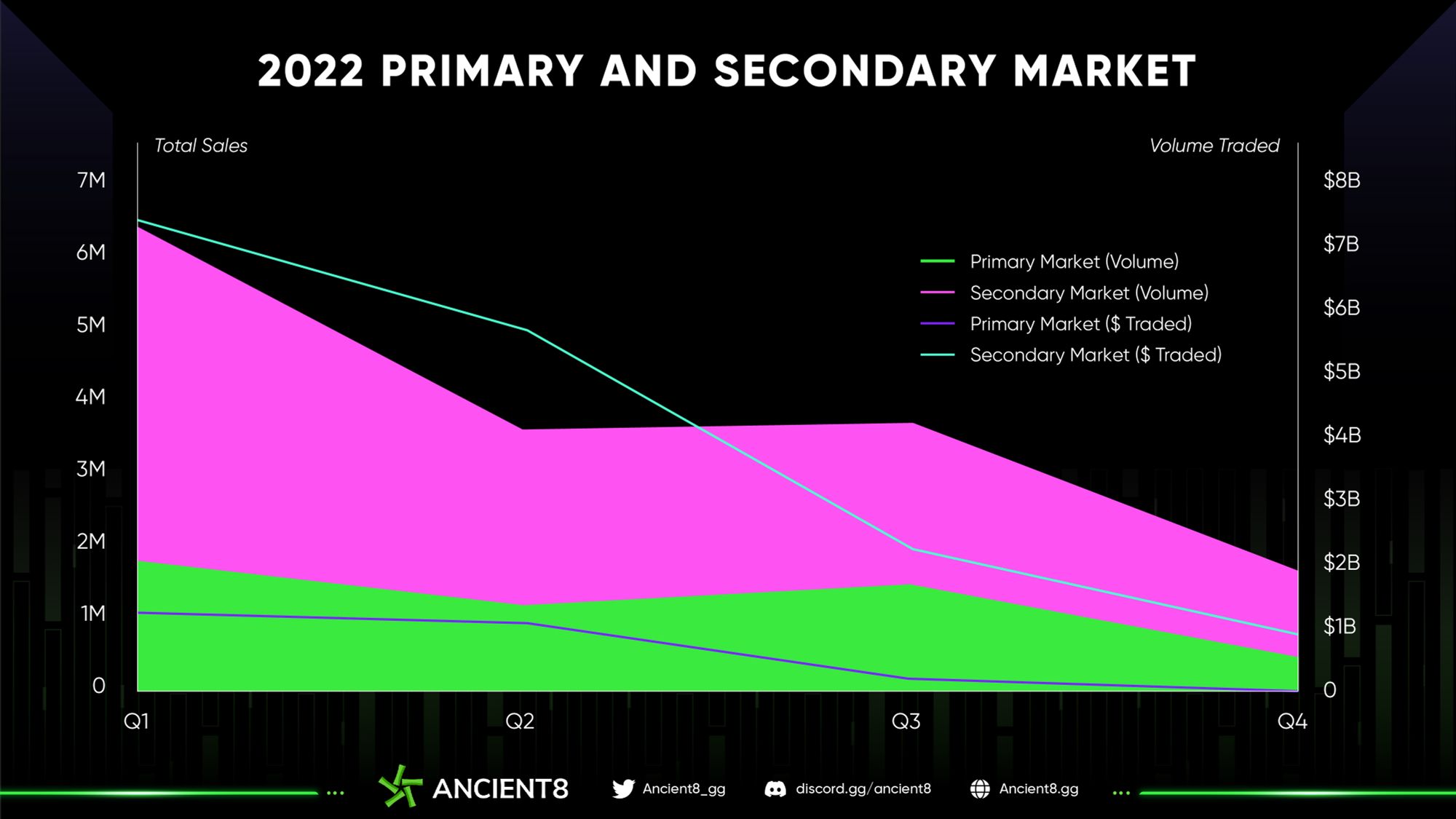

Primary and Secondary Market

Both primary and secondary markets faced tough headwinds in terms of volume traded, resulting in a steep downturn over the past year. However, we expect a rebound once the crypto market recovers. Notably, the secondary market ended the year with 86% dominance over the primary.

NFT Primary and Secondary Market in 2022 (Source: NonFungible)

In terms of sales volume, the primary market represented 29% in Q1 and reached a record high of 41% in Q3 before closing the year at 33%. The uptick in Q3 reflected fear of losing money in the secondary market due to high market volatility, hence owners preferred to keep their digital collectibles in their own wallets. Additionally, the quarter welcomed numerous new NFT projects which piqued the interest of users to “ape-in” to new collections, betting on the growth of new entrants rather than the blue-chip projects from the last bull cycle. Positive news in Q3 that inspired user adoption included the y00ts collection from Solana, the launch of Sandbox Alpha Season 3 and the Japanese government’s involvement in the utilization of NFTs in exemplary service (DappRadar).

NFTFi

While the intersection of DeFi and blockchain games creates GameFi, the marriage of DeFi and NFT forms NFTFi. These innovations allow NFT holders to put their idle digital collectibles to work to earn yield, making them more liquid. Some notable use cases of NFTFi include NFT fractionalization, NFT renting, NFT derivatives and NFT lending/borrowing. While NFTFi solves liquidity problems, it is still prone to exploits and pricing issues. However, the market cap of the blue-chip NFTs (BAYC, CryptoPunks, Azuki, Moonbirds) is very lucrative, with a total valuation of ~$3.5 billion. This will fuel excitement for NFTFi builders to keep innovating. We expect this subset of NFT will drive higher user engagement and open up a wide variety of new financial use cases in the future.

NFT Financialization Landscape

Launchpads

2022 Public Token Sales by Type

Launchpads are the backbones of the projects that bring NFT ideas to life. Projects that wish to bootstrap themselves and raise funds for growth and development have three options: IDO, IEO or ICO. Among all, IDO is the most favoured choice due to its open nature, representing 85% of total token sales in 2022. Some drawbacks of IEO such as gatekeeping, not-transparent vetting processes and listing fees drove users to IDOs where builders do not need to go through approval processes for listing. No KYC and geographical restrictions also make the IDO option more appealing.

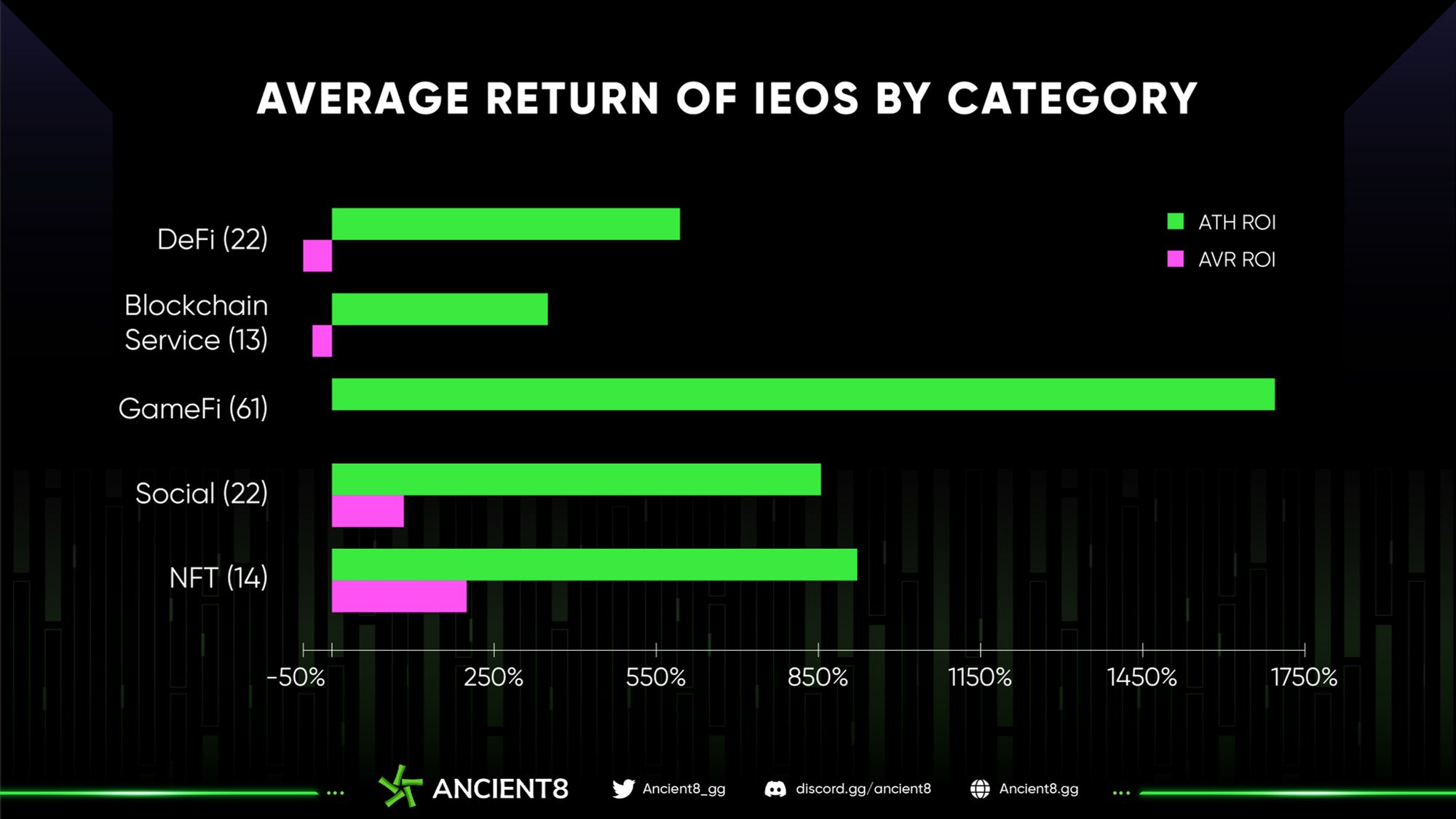

Average Return of IEOs and IDOs by Category in 2022 (Source: CryptoRank)

However, per the two bar charts above, projects that used the IEO crowdfunding approach enjoyed a higher average return compared to IDOs. Statistically, the average ROI of IEOs and IDOs across categories in 2022 was 57% and -73% respectively, revealing an astronomical distinction between the two approaches. Despite favourable returns from IEOs, we expect IDO/INO will gain higher traction and higher returns in the future as the space moves to embrace non-custodial wallets.

Top Launchpads’ Performance on NFT Projects (Source: CryptoRank)

NFTs stood out as the most profitable IEO sales with ~240% ROI on average in 2022, albeit having the second least number of projects launched (14 out of 132). Some notable centralized exchange platforms that hosted new NFT projects in 2022 include Huobi Primelist, Gate.io Startup and OKX Jumpstart, with Huobi Primelist being the most chosen platform by the NFT builders.

Projects Launched on IEO Platform

Marketplaces

The six largest NFT marketplace players are OpenSea, Genie, Gem, LooksRare, Blur and X2Y2. At a glance, it is easy to notice that OpenSea dominated the NFT marketplace in H1.2022 with record trading volumes in February and April of $3 billion. During the first quarter, a newly established platform X2Y2 entered the NFT competition and gradually gained traction in the market. At its peak in July, X2Y2 reached an impressive trading volume of $170M, becoming the second-largest player in the space.

NFT Marketplaces’ Trading Volume in 2022 (Source: Dune Analytics)

In H2.2022, the implosion of Terra Luna, FTX, and others dramatically cooled down the market. Amidst the chaos, we witnessed the birth of Blur, a trader-centric marketplace backed by Paradigm. Despite its relatively late start, Blur was able to dominate the market in a short period of time and unseated OpenSea as the leading NFT trading platform in December, seizing more than 50% of the market share. The entry of Blur does add some colour to the competition and makes for an interesting outlook for this industry as the market always welcomes fresh ideas with innovative approaches.

Remarkable Projects

One of the biggest movements in NFTs are community-owned collections of profile pictures, or “PFPs”, which have exploded to over $5 billion in sales this year. Crypto Punks, Bored Apes, and Azuki represent a major component of their owner’s digital identities and pseudonymous reputations online.

- Bored Ape Yacht Club: Minted initially for 0.08 ETH in April 2021, the 10,000 strong primate collection is one of the most successful NFT projects of all time. BAYC now has a floor price of 68 ETH with a total sale volume of 717K ETH. The best performance of BAYC was in April with a total sales volume of 41.9K ETH. One remarkable milestone of BAYC in 2022 was that it reached mainstream awareness on several instances, including a music video by Snoop Dog and Eminem. The success of BAYC is impossible to ignore as it gained massive popularity (or notoriety) across the globe.

- Azuki: Azuki is one of the hottest NFT projects in 2022 and has continued to build and develop its community despite the recent bear market. It is a collection of 10,000 avatars featuring anime-inspired artwork released in January 2022. Within 30 days of launch, Azuki’s sales volume reached $300 million, and its total sales even surpassed that of CryptoPunks and BAYC at one point. Azuki exploded in popularity in late March, with floor price nearing 40 ETH. At the time of writing, Azuki’s overall sales volume sits at slightly more than 278K ETH making it the 4th most traded NFT collection to ever exist.

- Moonbirds: The collection is described as “utility-enabled PFPs with a profoundly rich and distinct pool of rarity-powered features”. Moonbirds’ intriguing pixel-art design along with PROOF Collective’s reputation helped the project to catch a lot of attention from the community. Within 48 hours after the launch in April, Moonbirds racked up a total sales volume of $238M to become one of the top-grossing projects in the history of NFTs. The top 10 most expensive Moonbirds sales to date all surpass 100 ETH, with the most expensive one trading for a whopping 350 ETH. T****he project has revealed its plans to launch a DAO next year, with the mission of furthering the Moonbirds ecosystem, reputation, and lore.

Five most expensive Moonbirds (OpenSea)

- Doodles: The collection features 10,000 NFTs generated from hundreds of colorful traits of humans, cats, aliens, pickles, and more. This is one of the most loved NFT collections in the space. Airdrops and various side projects like Doodlebank, Noodles, Pukenza, Space Doodles NFTs and Dooplicator NFT from the Doodles NFT have helped these NFTs grow in popularity. The current floor price of a Doodle is 7 ETH with a total of 153.2K ETH volume traded. This year, Doodles revealed the details of how they are planning to expand the Doodles universe by partnering with Pharrell Williams and releasing an all-new NFT collection - Doodles 2.

- Reddit Collectible Avatars: This 40,000 avatar collection is the first instance of a Web2 social media giant entering the crypto space to bring NFT PFP to the mass. Notably, Reddit uses the term “Digital Collectible” instead of NFT to avoid quick-money-making scheme opinions and negative approvals from non-crypto groups. At the time of release, Reddit managed to sell out all their digital avatars and gained 2.5 million Reddit Vault wallets created on their marketplace. A highly accessible platform coupled with well affordable price (~$10) has helped the collection reach millions and garnered $12 million in total sales volume.

- Valhalla: Valhalla is “a crypto native brand for gamers around the world" that has blown up on social media here at the end of 2022. The 10,000 PFP Avatars of Valhalla hit big on the secondary market after the mint in November. It was the top project based on sales volume, and within the top three alongside CryptoPunks and BAYC. Valhalla now has 3.4K unique owners with a total volume of 11.6K ETH traded. The current floor holds an average of 1.17 ETH. In the near future, the team plans to work on a few initiatives to expand the IP and strengthen the brand as a web3-native tech platform and release a marketplace which is set to launch for holders in Q1 2023.

Outlook for 2023

The NFT ecosystem has come a long way in the last two years. It saw explosive growth in 2021, but this growth hasn’t been consistent and largely cooled off in 2022. However, NFTs remain very trendy and will still be around in the upcoming years as people will always find value in being a part of these communities. 2023 is anticipated to see the transition of NFT gaming from adolescence to adulthood as new trends continue to emerge in this market.

NFT PFPs have grown immensely since the launch of CryptoPunks in 2017. Interest in NFT PFPs grew 509% over the past year compared to the year before, putting the term at a current search volume of 1.8K searches per month (Glimpse) and will remain a hot trend in 2023 due to their strong communities, unique utilities, partnerships, and collectibility. Additionally, Artificial Intelligence and NFTs could make a great pair in 2023 providing a wholly unique and dynamic experience. NFT fragmentation is also a new trend to watch as it makes high-value NFTs more liquid and accessible to investors.

Since their inception, NFTs have continued to gain popularity and have already made a significant cultural and financial impact in the market. With the staggering potential of NFTs, not only web3 but also web2 industries are now adding NFTs to their marketing arsenal to build connections with consumers across physical and digital mediums. As the public and private sectors continue to learn and understanding the value of this technology, we can expect a bright future for NFTs in the years ahead.

Conclusion

Volatility in crypto is nothing new, and 2022 was truly a rollercoaster ride for the entire industry and marks a remarkable chapter in the crypto history books. It will serve as a valuable lesson to remind crypto-native builders and newcomers alike that crypto is still “a work in progress” but also how far it has come. Innovators and visionaries who focus and keep building will shape the future of this rapidly changing field.

Web3 gaming and NFTs are arguably the most forward-thinking industries in terms of leveraging blockchain technology to bring crypto to the masses. After a promising start to 2022, economic and social turmoil has affected global markets, especially tech. Crypto and NFT enthusiasts have endured declining token prices, major collapses, and hacks. But despite all the FUD (both real and imagined), web3 gaming and NFTs are still very much alive and pushing forward.

There will be more challenges and setbacks as the industry evolves, but at the same time, we expect that market recovery, adoption from Web2 companies, and meaningful tech innovations will be the catalysts for many new and exciting NFT and Web3 Gaming projects and trends next year, and for many more years to come.

At Ancient8, we always strive to bring the best infrastructure layer for web3 gaming by leveraging our unique position at the intersection of development, marketing, and distribution for web3 games. As a leading guild and early partner to over a dozen games, Ancient8 understands the need for solid infrastructure to support the sustainable development of the industry in upcoming years while the funding and expertise of our world-class backers will power GameFi and Metaverse projects to onboard and manage communities at scale. Our community, education, research, investments, and Esports initiatives are clear testaments to our abilities and leadership in web3 gaming.