Key Takeaways

- Co-founded by the pseudonymous Pacman, Blur aims to fulfill the needs of pro-traders that existing retail centric NFT marketplaces couldn’t.

- Since successfully launching their $BLUR token on February 14, the NFT marketplace has reached an impressive 77.9% in volume market share with $262 million processed just this past week (Dune).

- Pro traders and whales contribute the majority of NFT trading volume today, with more than half of Blur’s massive volume coming from just 500 top wallets.

- Blur’s strategy is to incentivize liquidity over volume. This is achieved through their innovative bidding feature similar to automated order book systems in DeFi. This is providing millions in liquidity for NFTs that weren’t available before.

- As Blur and OpenSea compete for market share, creators are caught in the middle of a contentious “Royalty War” with each marketplace rolling out their respective royalty enforcement policies.

- Blur has demonstrated their product market fit and aims to further decentralize into the future, taking a community-driven approach to growing the platform.

What is Blur?

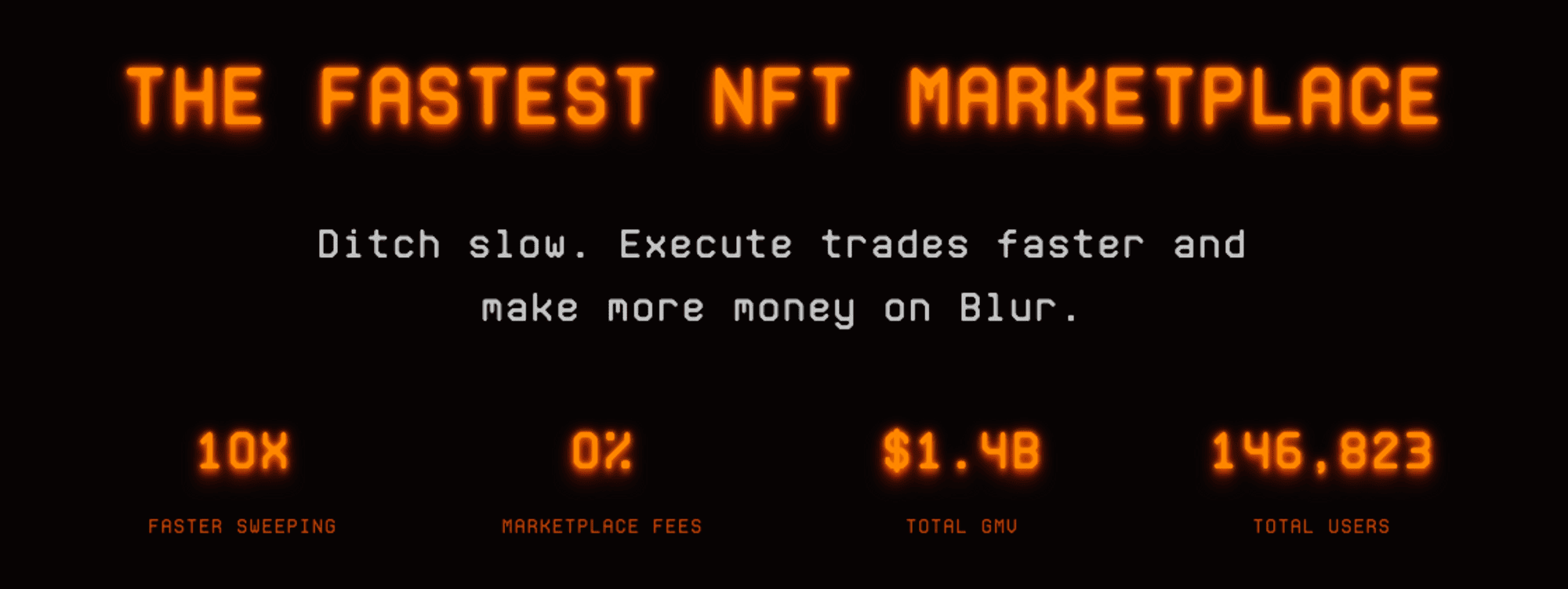

Blur is a NFT marketplace aggregator that has quickly become a leading player in the space, consistently dethroning OpenSea in volume. The team behind Blur consists of talent from organizations such as MIT and Citadel, and the platform is backed by crypto venture firm Paradigm. Blur’s seed round raised a total of $11 million with participation from notable figures in the NFT and crypto space such as Punk 6529, Cozomo de’ Medici, and Zeneca.

The face and co-founder of Blur is Pacman, a Y Combinator alumni and Theil Fellowship recipient that dropped out of MIT to start Namebase. He would later sell this company to Namecheap, the domain name registrar and web hosting giant. The inception of Blur came from Pacman’s frustrations with the existing infrastructure of the NFT ecosystem, which he identified as a “very large gap in the space” with all marketplaces being “very retail focused” (Empire). Thus, the core functionality of Blur is to serve these power users needs, providing features such as great UX/UI, lightning fast pending transaction times, gas priority settings with optimized contracts, and floor sweeping tools.

“The clear pain point on day one is that there is a need for power users that is not filled at all” - Pacman (Source: Empire)

In addition, airdrops and token incentives also further appealed to their target demographic. It is crystal clear that Blur has identified an effective approach, standing out from its competitors.

Capturing Market Share

Blur exhibited impressive activity and growth since its launch on October 19, 2022. The general response from the community was positive and existing traders quickly flocked to the platform. Though also impacted by the FTX situation in November, the number of Daily Active Wallets quickly recovered and climbed 191% in the last month of 2022 in anticipation of the $BLUR token release (DappRadar).

Daily Active Users on Blur Since Launch - (Source: Token Terminal)

On February 14th, the $BLUR token successfully launched with $1.1 billion in trading volume in the first 24 hours (The Block). That same day NFT trading volume on Blur also quadrupled to a total of 6602 ETH, surpassing 5649 ETH on OpenSea (AltCoinBuzz). This first drop was dubbed “Season 1”, and $300M in $BLUR was distributed based on its loyalty program. The highest rewards went to those who exclusively listed, traded and bid on the Blur platform. According to data curated on Dune, the top recipient in the BLUR airdrop claimed 3.2 million $BLUR, which is valued at ~$1.7 million USD based on current prices. Though there is speculation of wash trading and manipulation among top wallets, it is a relatively small chunk of the total allocation.

As of this report, Blur has reached an impressive 77.9% volume market share, with $262 million just this past week (Dune). This volume can be attributed to considerably higher average NFT sale prices on Blur compared to OpenSea. As can be seen in the graphic below, the average sale on Blur has remained consistently 2-3x higher.

Blur vs. OpenSea Weekly Volume Since Launch (Source: Dune)

Daily Average Trade Price on Blur vs. OpenSea (Source: Dune)

Volume doesn’t tell the full story. While it’s easy to jump to the conclusion that Blur has taken OpenSea’s market share, we also need to consider how many users are actually making the jump. According to Dune, trader market share for Blur has been growing steadily but has only reached 42% of OpenSea’s user base (Dune). OpenSea still retains the majority segment of NFT buyers in the space.

Blur vs. OpenSea Weekly Users Since Launch (Source: Dune)

It’s no secret that a handful of pro traders and whales in the space can contribute to a large portion of trading volume. From on-chain data and analysis by @0xKofi and @jphackworth42, a whopping 53% of Blur’s volume comes from just 500 wallets. It becomes clear that Blur is successfully attracting high value trades and pro traders to their platform, while the masses remain on OpenSea. Thus, while it may be too early to claim that Blur is capturing OpenSea’s market share, they have definitely captured the pro trader demographic. While we can expect the retail and consumer segment of the market to be bigger and more important in the coming years, what we can observe is that pro traders and whales drive the majority of NFT trading volume today.

Liquidity vs. Volume

An innovative feature Blur has introduced to the NFT market is essentially an order book system similar to that of Crypto CEX’s and DEX’s. Instead of converting ETH into WETH to send offers on OpenSea, users can now deposit their ETH into a Blur bidding pool. This reduces user friction allowing them to directly use their deposits for sending various bid offers or even purchasing NFTs directly. Bidders who are closest to the floor price are rewarded the most, so there is heavy incentive to maintain active bids in order to farm $BLUR rewards.

Additionally, Blur also boasts zero marketplace fees which increases traders profit margins, and promotes increased trading activity on the platform. This is how Blur incentivizes liquidity rather than volume. As Pacman states in his Empire interview referencing existing marketplaces such as LooksRare, “(incentivizing) volume brings wash traders, whereas liquidity is real” (Empire), which allows volume to come organically.

Total Value Locked (TVL) on Blur as of 13/03/23 (Source: DeFi Llama)

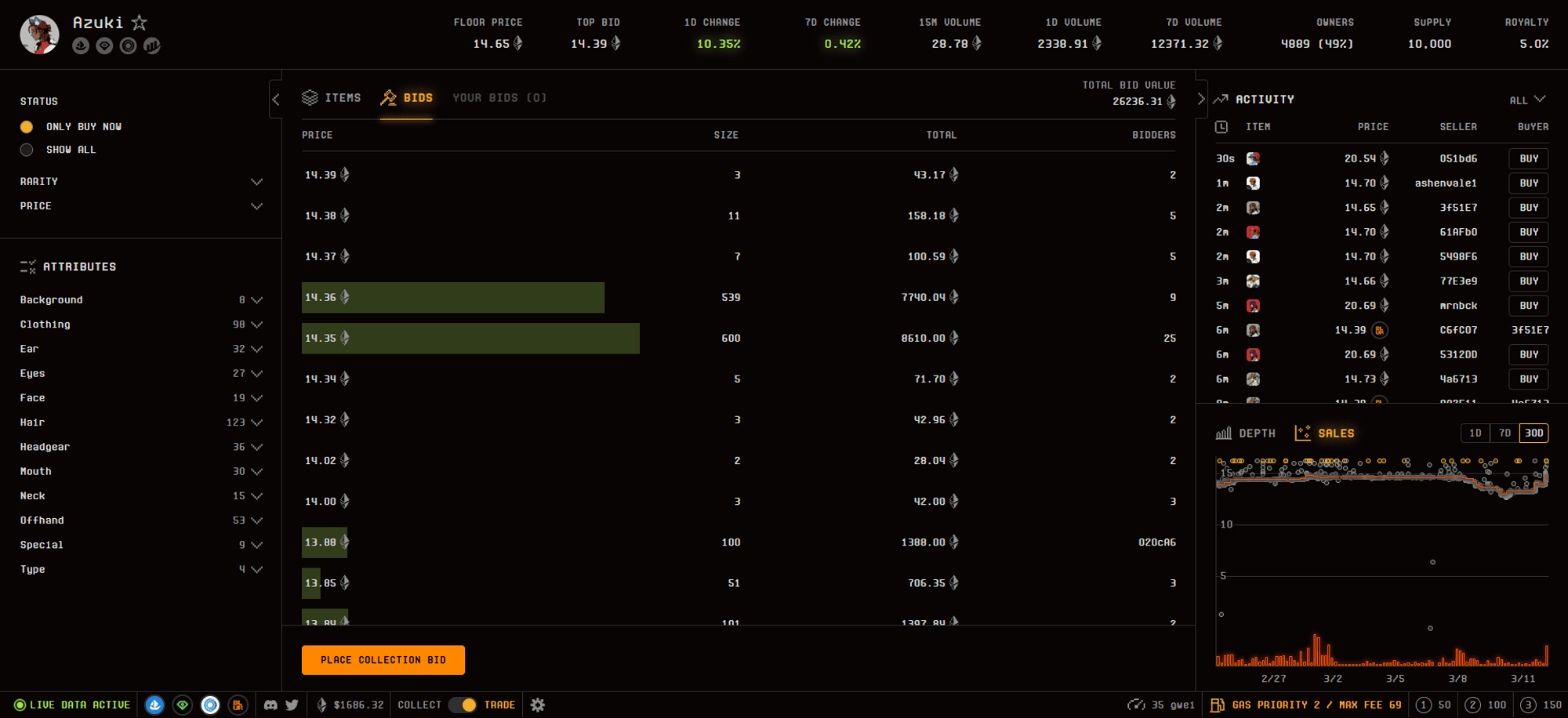

The advent of Blur’s bidding system combined with reward incentives to provide liquidity has illustrated the past inefficiencies of the NFT market. Prior to Blur, if a trader needed quick liquidity and had to sell a large number of NFTs, they generally had no choice but to crash the floor price of a collection. This is no longer the case, as there are now “bid walls” of liquidity that sellers can instantly sell into without cratering the floor. On blue chip collections, these bid walls can be massive. For example, Azuki currently has 26,237 ETH worth of total bids, with the majority of the bids hovering just under the floor price. While NFTs are often described as a highly illiquid asset class, we are seeing Blur shift the narrative. There are now millions in liquidity that wasn’t available before, the process of selling and buying has been optimized which sparks real trading activity. The market has been made more efficient.

“The issue with NFTs before was that the market was highly inefficient, for various structural reasons…with Blur now there is significantly more activity on the market making side” - Pacman (Source: Empire)

26,237 ETH ($44M USD) Worth of Bids on the Azuki Collection (Source: Blur)

Though reception to the airdrop and the platform has been mostly positive, contentious discussion has spurred on the effects of $BLUR farming in the long term. The criticism that activity from the top 1% of traders is still manipulation and unhealthy for the market is a valid concern. While temporary liquidity is provided in the short term, many $BLUR farmers are accumulating inventories of NFTs that may be dumped after the incentivized period ends, potentially crashing floor prices. Furthermore, Blur’s approach as an NFT marketplace also shifts the space from an aesthetic vantage point to one focused on mere quantity. The market is clearly evolving and inefficiencies are being addressed, but the sustainability of incentivized liquidity still remains to be tested in the long run.

The Royalty Debate

Blur launched with a royalty-optional model similar to that of its competitor X2Y2 in October. However, the platform has since made changes, such as expanding royalties to permissioned NFTs in November and enforcing a minimum royalty fee of 0.5% in December.

However, following OpenSea’s policy change which attempted to ban royalty-optional marketplaces by forcing creators to block them in order to earn full royalties, Blur retaliated with their own royalty enforcement policy.

As of February 15th, Blur announced that creators on its platform who wish to collect full royalties will need to blocklist OpenSea. Creators can do so by amending their NFT contracts with code that restricts sales of their collection on marketplaces that don’t honor royalties. This is option three as can be seen in the graphic below. It’s worth mentioning Blur does include an Option 4, which is neither platform blocking each other, stating “We would like to welcome OpenSea to stop this policy, so that new collections can earn royalties everywhere.” (Blur).

Blur’s Royalty Policy for Creators (Source: Blur)

Let’s take a look at the data. Following Blur’s token launch on February 14th, the platform has since paid out more in creator royalties than OpenSea. Most notably on March 3rd, Blur paid out over $1.7m in royalties in a single day compared to $282k from OpenSea. These numbers are indicative of Blur’s approach of incentivizing liquidity.

Royalty fees (%) paid to creators by different marketplaces (Source: Dune - @hildobby_)

Even with minimum royalties of 0.5%, this was compensated by the massive volume happening on Blur, which ultimately contributed to significantly greater royalty payouts. This was especially prevalent in blue chip collections, such as Bored Ape Yacht Club, Mutant Ape Yacht Club, Azuki, CloneX, Moonbirds, and Doodles.

Royalty fees ($) paid to Blue Chip Creators by different marketplaces (Source: Dune - @hildobby_)

As Blur and OpenSea utilize royalty enforcement as a means of competing for market share, it is yet to be determined who will come out on top. One thing is for certain, creators are caught in the middle with many vocalizing their views on the hot topic. Creator royalties have been a core value proposition for NFTs. While the fallout today is resulting in short-term profits, the current state of the marketplaces are concerning when it comes to the long-term viability of NFTs as a creator platform.

The Future of Blur

In the span of a few short months, Blur has demonstrated their product market fit and successfully tapped into the needs of professional NFT traders. The first season airdrop was a great success, kicking off the “incentive flywheel…creating real network effects” (Delphi Digital). Currently “Season 2” is active with a similar sized token allocation to be distributed, however the end date has not yet been disclosed. As the price of $BLUR has since retraced from its all time highs to $0.67 at the time of this report, the profitability and long term activity of farming $BLUR is uncertain.

Upon claiming season one airdrop rewards, users were greeted with a cryptic “idea map” vaguely resembling a roadmap. Though not explicitly announcing specific plans and timelines, Blur’s development plans hint at a new fee structure, loyalty program, and a potential Artblocks partnership.

Blur’s cryptic “idea map” (Source: Blur)

Contrasting the cryptic and mysterious idea map, Blur has made it clear they are aiming to take a more decentralized approach to its growth as a platform. The plan is for BLUR token holders to participate in governance and “control the protocol's value accrual and distribution” (Blur). A Blur Foundation has also been set up to “facilitate community-led governance and participation in the DAO and assist contributors with the development and growth of the Blur ecosystem” (Blur). The future vision of Blur is to be community-driven.

Notable NFT figure Zeneca alongside co-founder Pacman are directors of the Blur Foundation (Source: Blur)

"The philosophy that we kind of had in designing the system as core contributors is that we wanted to be able to deliver value immediately, have a clear story for why the protocol is able to accrue value, and ultimately give the holders the flexibility to utilize different schemes in the future as market conditions change” - Pacman (CoinDesk)

Closing Thoughts

Blur has demonstrated their ability to build an effective product, however their longevity remains to be seen as competitors such as OpenSea are quickly responding with their own changes. It’s clear there is a passionate community of dedicated NFT traders who are likely to continue using Blur in the long run, but this may not be the case with newer and casual buyers. As we observe the adoption of NFTs in a fast evolving market, we will be watching closely as Blur continues to build out their roadmap and further decentralize. The vision to protocolize an infrastructure product and “give away billions of dollars worth of value to the community” as Pacman himself states (Empire), has the potential to revolutionize the space.