Special thanks to Kyros Ventures for the collaboration in conducting this research.

DISCLAIMER: THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY. IT IS NOT A RECOMMENDATION TO PURCHASE TOKENS OR ANY OTHER ASSETS. ANY INVESTMENTS MADE IN THE PROJECTS OR ASSETS MENTIONED BELOW ARE DONE SO AT YOUR OWN RISK. THIS IS NOT FINANCIAL ADVICE.

Before Axie Infinity became a global phenomenon, few were even aware of the existence of GameFi. It took the perfect-storm combination of the global pandemic, crypto bull market, and play-to-earn model, to spark an explosion of interest and investment in GameFi.

During this great Emergence of GameFi in 2021, many blockchain gaming services were launched, facilitating capital flow into the industry. In this report, we analyze the GameFi ecosystem across various blockchains, the funding landscape, and breakthrough services of last year, namely Guilds and Launchpads.

Overview

The GameFi industry experienced dramatic growth in 2021 as Unique Active Wallets (UAW) surpassed 1M for the first time. UAW increased 318% in Q3 alone. However, the trend cooled off in Q4. After reaching an ATH of 1.5M UAW on Nov 30, UAW readings closed the year at 1.2M active users, down 6% from the start of the quarter.

Figure 1: GameFi Daily Unique Active Wallets (DappRadar)

GameFi has proven to be a significant driver of on-chain activity. GameFi users accounted for 49% of activity across all UAW in Q4 2021. Per the chart below, GameFi-related activity spiked in Q2 as Axie Infinity successfully migrated to Ronin and Alien Worlds enabled trillium mining. GameFi activity even exceeded that of DeFi in August as many new games were announced, snowballing into a trend that was impossible to ignore.

Figure 2: UAW by Category during 2021 (DappRadar)

These milestones were largely enabled by the success of one game; Axie Infinity deserves recognition for leveraging the play-to-earn model to allow users to generate income– a godsend for many during the economic fallout caused by the pandemic. By introducing friends and neighbors to Axie Infinity, young gamers in developing countries provided the “butterfly effect” that sparked the emergence of the GameFi era.

Axie Infinity

The success of Axie Infinity has captured the attention of both the crypto market and the global gaming industry. The pioneering Play-to-Earn protocol ranks third in cumulative revenue behind only Filecoin and Ethereum, the dominant L1 ecosystem. Watch this dramatic ascension play out in this short clip. The rise of Axie has inspired countless GameFi projects and drawn significant funding into the GameFi space. Axie has laid the groundwork to become the first blockchain company able to challenge the dominant legacy players in its industry.

With over $1.26B in protocol revenue, 98.5% of which was accumulated in the past 180 days, Axie Infinity quite literally earned the 2021 Crypto MVP (most valuable project) award. Its phenomenal growth has even outpaced some of the most popular AAA titles. Epic Games’ cash cow Fortnite managed to reach its first million users in August 2017, two years after its closed Beta (Statista). Meanwhile, Axie reached two million users in its Alpha stage alone. And Sky Mavis, the Vietnam-grown studio behind Axie, has not even dove into the Free-to-Play model… yet.

Figure 3: GameFi/Metaverse Projects Landscape

As mentioned, Axie has delivered an inspirational story for all GameFi projects to follow. Before Axie, there were only around a dozen GameFi projects, and the term “play-to-earn” was not widely known. Today, over a thousand GameFi projects and counting are being developed and launched across blockchains including Ethereum, BSC, Polygon, Solana, etc.

Further proof of Axie Infinity’s role in popularizing GameFi can be found in Google Trend analytics. Axie’s breakthrough success attracted global attention, and Google searches for the title peaked in June-July. This lines up perfectly with the start of an exponential increase in searches for “GameFi”, which peaked in November.

Figure 4: Google Trend - Axie Infinity & GameFi

Rapid growth comes at a price: blockchain network congestion. Having witnessed Ethereum struggle to handle the activity generated by Cryptokitties in 2018, Sky Mavis prioritized building their Ronin network to safeguard Axie’s long-term scalability. The L2 solution helped them avoid Ethereum’s gas fees and also incubate Axie’s blooming season later on.

Not all GameFi projects can develop their own blockchain. Many choose to adopt other L2 solutions instead, or launch on more efficient L1 chains like Solana, Avalanche, WAX, etc. This will continue to drive demand for L1 alternatives to Ethereum.

GameFi on Ecosystems

Despite the pre-Ronin success of Axie Infinity on Ethereum, the low transaction finality, high gas fees, and lack of scalability is deterring other blockchain games. As a result, we have witnessed a surge in games built on other high-performance blockchain networks in the second half of 2021.

The proliferation of GameFi projects has bolstered the robustness of blockchains themselves. From the start of 2021, weekly users increased by over 482% on blockchains with top GameFi ecosystems, according to on-chain data.

On average, GameFi accounted for 40% of total blockchain users in the second half of 2021 (DappRadar), an impressive feat against DeFi, Exchanges, etc. Among the NFT/game-focused blockchains, BSC and WAX deserve the spotlight, growing from 2.69M and 2.58M weekly users in June 2021 to their ATHs of 8.97M and 3.4M, respectively, in the second half of 2021. Ronin Network (Axie Infinity) has exploded from approximately 300 users in January 2021 to nearly 740,000 users per week in December (DappRadar).

Figure 5: Total Active Users per week by Blockchains in 2021

GameFi also accounts for an average of 77% of transactions executed across all networks, outperforming DeFi (Dapp Radar). The total number of transactions executed on these blockchains shot up 98% from pre-GameFi levels. Total transactions reached a weekly average of 135.8M in the second half of the year, up from the pre-GameFi average of 68.5M transactions per week. This data once again demonstrates the tremendous impact of GameFi on the activity and robustness of these blockchain ecosystems.

Figure 6: Total Transaction per week by Blockchains in 2021

Empowered by improvements in tokenomics and gameplay models, new and upcoming gaming projects are expected to increase all of these metrics significantly in 2022. Per the data below, BSC has overtaken Ethereum as the preferred blockchain for new GameFi projects and infrastructure with a record of 315 games as of Dec 2021.

Figure 7: Total number of games by Blockchains

BNB Chain

Figure 8: Top gaming projects on BNB Chain

BNB Chain achieved outstanding growth in 2021, largely thanks to GameFi projects, rather than DeFi. Total revenue generated on BNB Chain surpassed $600M, up from only $2.2M in June 2021 (Token Terminal).

BSC network is home to many GameFi projects making waves in the play-to-earn community including CryptoZoon, CryptoBlades, and Mobox. BSC boasts remarkable metrics in both user base and trading volume. However, many other projects suffered negative price movement, damaging investor confidence in the quality of GameFi projects on this network.

Polygon

Figure 9: Top gaming projects on Polygon

Offering advanced user experience with higher throughput and scalability for Ethereum network, Polygon has built a diversified ecosystem of GameFi projects contributing to a growth in total revenue from $11K to over $8.9M during the second half of 2021 (Token Terminal).

Solana

Figure 10: Top gaming projects on Solana

Q3 2021 marked the advent of both the DeFi and GameFi ecosystems on Solana. In contrast to BSC, Solana has bolstered its reputation by welcoming high-profile GameFi projects backed by big names in the industry including FTX, Solana Ventures, Alameda Research, etc.

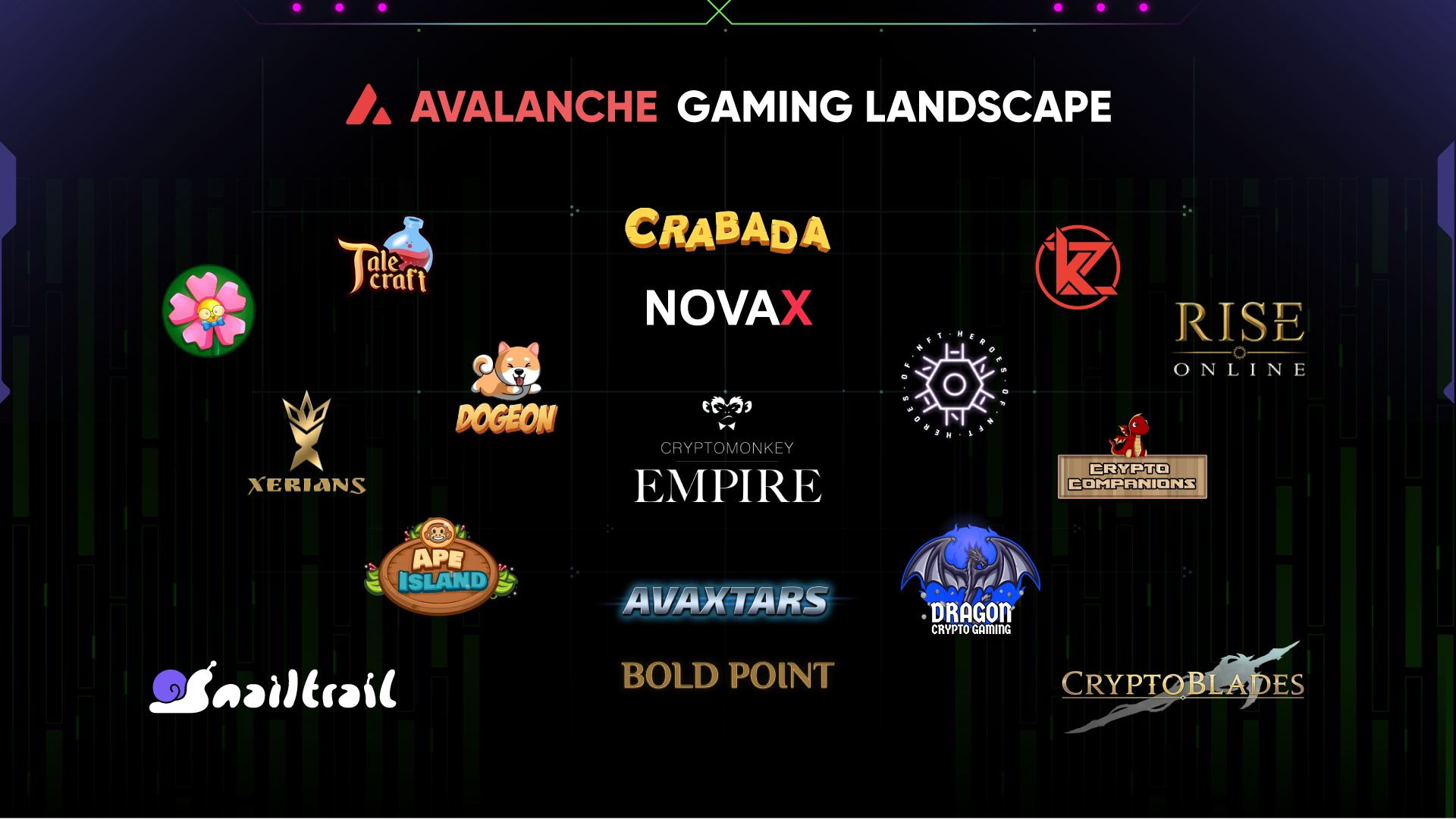

Avalanche

Figure 11: Top gaming projects on Avalanche

Avalanche has the potential to be the next game-changer in the GameFi landscape. With EVM compatibility, instant finality, and user capital efficiency, Avalanche has attracted a number of GameFi projects bolstering the diversity of its ecosystem.

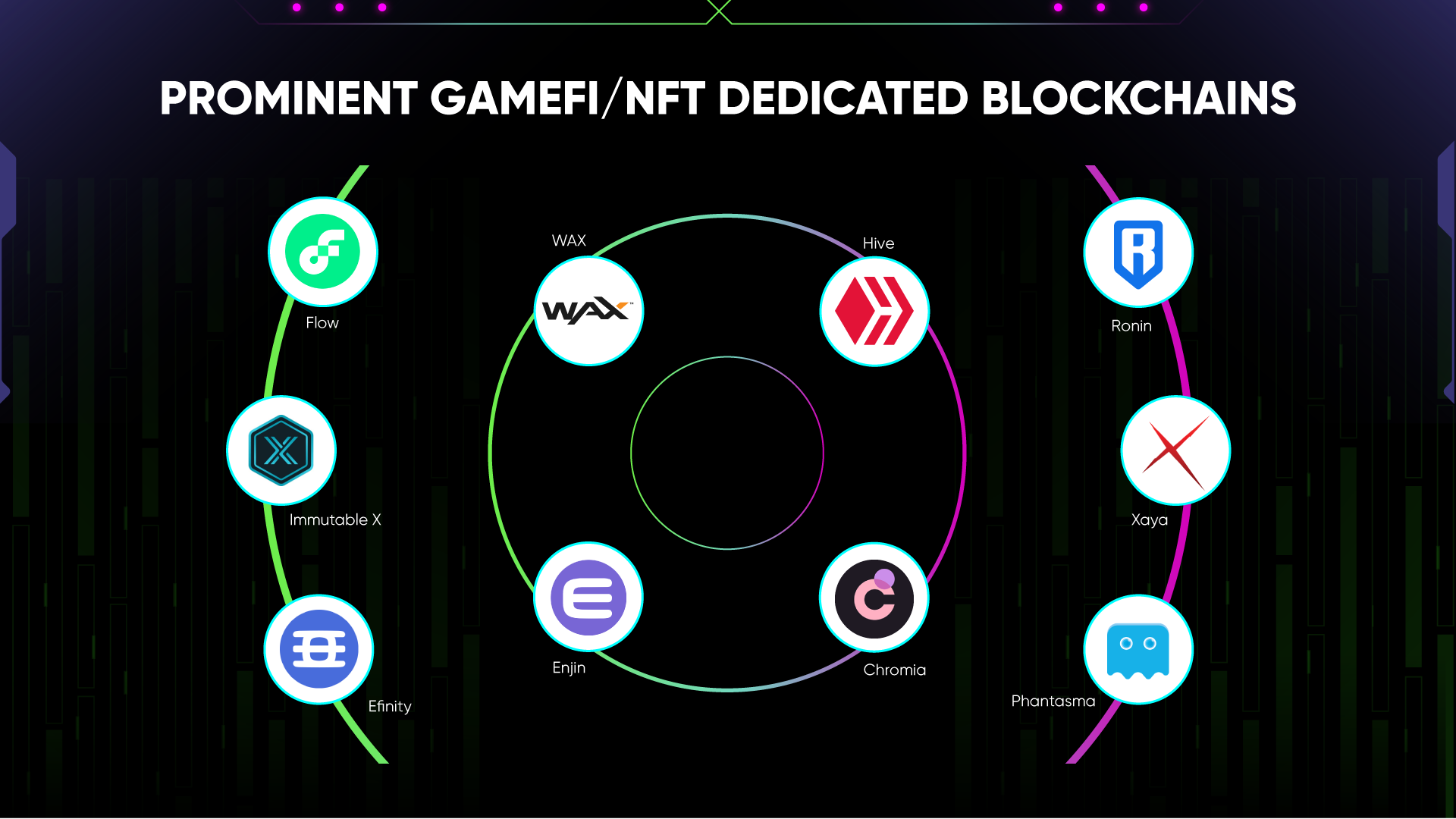

NFT/Gaming-Focused Blockchains

Several blockchain and side chain solutions have been developed exclusively for NFT/Gaming to capture the ever-growing demand while ensuring a reinforced infrastructure for the sector.

Figure 12: Prominent GameFi/NFT Dedicated Blockchains

Hive, WAX, and Enjin stand out as leaders in this sector offering solutions and infrastructure for a considerable number of well-known blockchain games such as Splinterlands, AlienWorlds, Farmers World, Lost Relics, etc.

Splinterlands, for example, is an NFT card game on Hive and WAX, and one of the most popular blockchain games with a record of nearly 750K active users along with a volume of $2.5M within the last 30-day period (DappRadar). The expansion of these NFT Gaming-exclusive environments is a positive signal for the future of GameFi.

GameFi Funding Landscape

GameFi has notable advantages over DeFi that have piqued the interest of VCs. The fundamental DEX offerings of Lending/Borrowing, Derivatives, and Synthetic Assets remain the primary value props in DeFi, but have lacked any noticeable development.

Meanwhile, institutional funding in GameFi is expanding the sector’s user base growth, scaling solutions, in-game assets ownership, storage infrastructure, and community services. According to Footprint Network, GameFi accounted for nearly 16% of the total number of investments made in the blockchain space in 2021.

Figure 13: Top GameFi/Metaverse Active VCs

Capturing the potential of GameFi/Metaverse, some VCs actively incubate and invest in this emerging sector including the pioneers of Kyros Ventures, Animoca Brands, Coin98 and Kyber Ventures, to name a few. The list of active VCs in GameFi/Metaverse also includes big names in the industry including DeFinance Capital, Pantera, Binance Labs, A16Z and Huobi Ventures. To demonstrate its commitment to GameFi, Binance organized the MVB III, directly targeting GameFi projects; the winners will be granted $10K along with a complete security audit from Certik and various incubation programs.

Figure 14: Binance Smart Chain MVB III Gaming Participants

2021 saw a significant increase in blockchain funding in general and GameFi/Metaverse funding in particular. The total amount raised by GameFi/Metaverse projects and underlying infrastructure surpassed $4 Billion (Blockchain Gamer).

GameFi is a gateway for traditional VCs and Gaming Studios to gain exposure to the blockchain space. Softbank, Atomico, and Bessemer are paving the way with major investments in Sorare, which closed a successful year with nearly $738M raised for just this project alone (Blockchain Gamer).

In late October, Mark Zuckerberg shocked the world by revealing Meta’s (previously Facebook) long-term vision of the metaverse along with a $50M fund. This marked a pivotal turning point and catalyst for GameFi/Metaverse funding, with a number of funding announcements and major investments in Forte, Game7, Mythical Games, etc. per the metrics below.

Figure 15: GameFi & Metaverse Investment Landscape

Launchpads

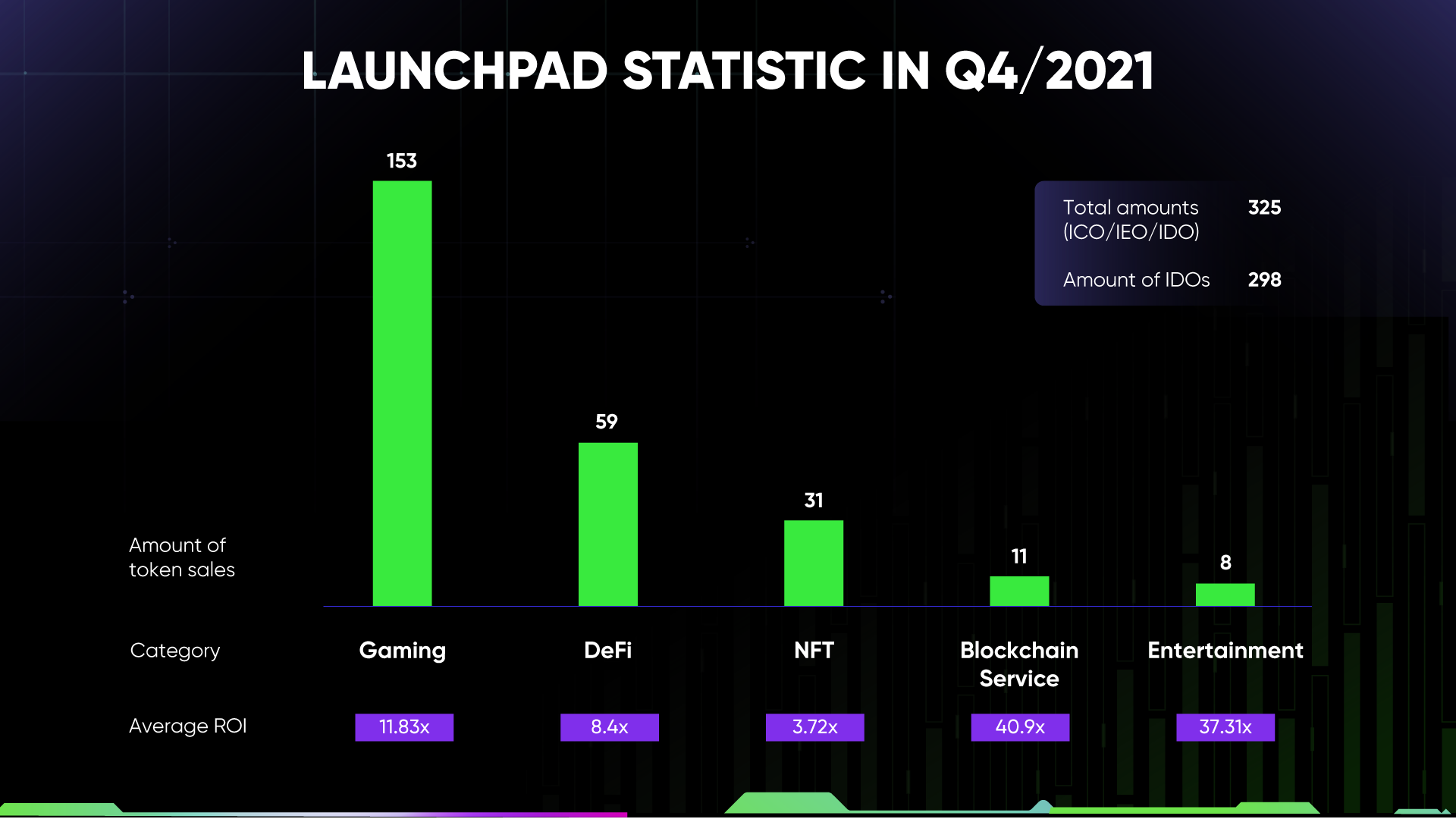

Retail investors also play an important role in the success of these GameFi projects, and they too seek to invest in GameFi. To fill this growing demand, launchpad platforms have developed innovative services to connect them directly with projects. This growing trend has positioned launchpads as one of the most practical tools for retail investors to invest in GameFi.

The dominance of the GameFi sector on launchpad platforms is clear. In 2021, there were nearly 800 token sales across all launchpad platforms and a quarter of them were for GameFi projects (CryptoRank). Q4 was a significant period, during which GameFi token sales accounted for 153 out of the 325 total sales across all launchpads. 75% of all GameFi token sales in 2021 happened in Q4.

Figure 16: Launchpad statistics in Q4/2021

Figure 16: Launchpad statistics in Q4/2021

The ROI in GameFi was also extremely high, with an average of approximately 1100% in Q4 2021.

Almost all token sales were executed on decentralized platforms as IDOs (Initial DEX offerings). Because of the high potential ROI, many investors want to buy GameFi tokens through public sales. Many launchpad platforms have boosted their own token’s value by requiring users to hold their token to participate in IDOs on the platform.

Figure 17: ATH ROI of Launchpad token in Q4/2021

Along with token sales, GameFi projects sold in-game assets in the form of non-fungible tokens (NFTs) to raise funding. Binance hosted its first “initial game offering” (IGO) in November 2021.

NFT sales have proved a successful funding-raising strategy for game developers. However, the surge in demand for these NFT assets increases as the game becomes popular. This creates a significant barrier to entry for new users who want to play and earn but cannot afford the initial cost of buying the NFT. Gaming guilds were born of the need to solve this pain point and onboard new gamers into the community.

Blockchain Gaming Guilds

How it started

As previously mentioned, the economic fallout from the pandemic was a principal driver of Axie Infinity’s user growth in developing countries in Asia where many people struggled to make ends meet.

According to BitPinas, when Axie Infinity first caught on, workers in some regions of the Philippines could earn about 3 times their average income from playing Axie. As the blockchain gaming phenomenon exploded, the floor price of Axie NFTs skyrocketed to $495.5, up 76% in 2 weeks (CryptoSlam).

The elevated demand for play-to-earn assets has made the entry price to play Axie too high. Organizations with financial resources stepped up and introduced the Scholarship model. The early pioneers of this model were Guilds like Yield Guild Games and hedge funds like Blackpool Academy.

A new business model

The emergence and development of the gaming guild model have caused a fundamental shift in the way many perceive the blockchain space as well as the gaming industry. This unique business model generates revenue by managing Scholars across various games, and also from investments in the crypto assets of games or even other guilds.

At the end of Q4 2021, Axie Infinity was still the most popular game in guild portfolios. Axie has also managed to maintain a loyal, global fanbase.

In the past year, GameFi project tokens have experienced an extremely high ROI. Early GameFi investment strategy is working well for Gaming Guilds, highlighted by YGG's greatest ROI of over 44,000% from a $20,000 investment in Illuvium (figure 18).

Figure 18: YGG Q3 Treasury Report Breakdown

Investing in Game NFTs has become a lucrative strategy for guilds, and we expect this trend to continue. Top-tier games like CyBall spend nearly half a year on community building and product preparation, and also receive guidance and support from investors who have built successful projects in the past. When these games launch, the demand for their NFTs will skyrocket and Guilds will benefit the most as they have been quietly accumulating the NFTs directly from top-tier games.

Player Distribution & Localization

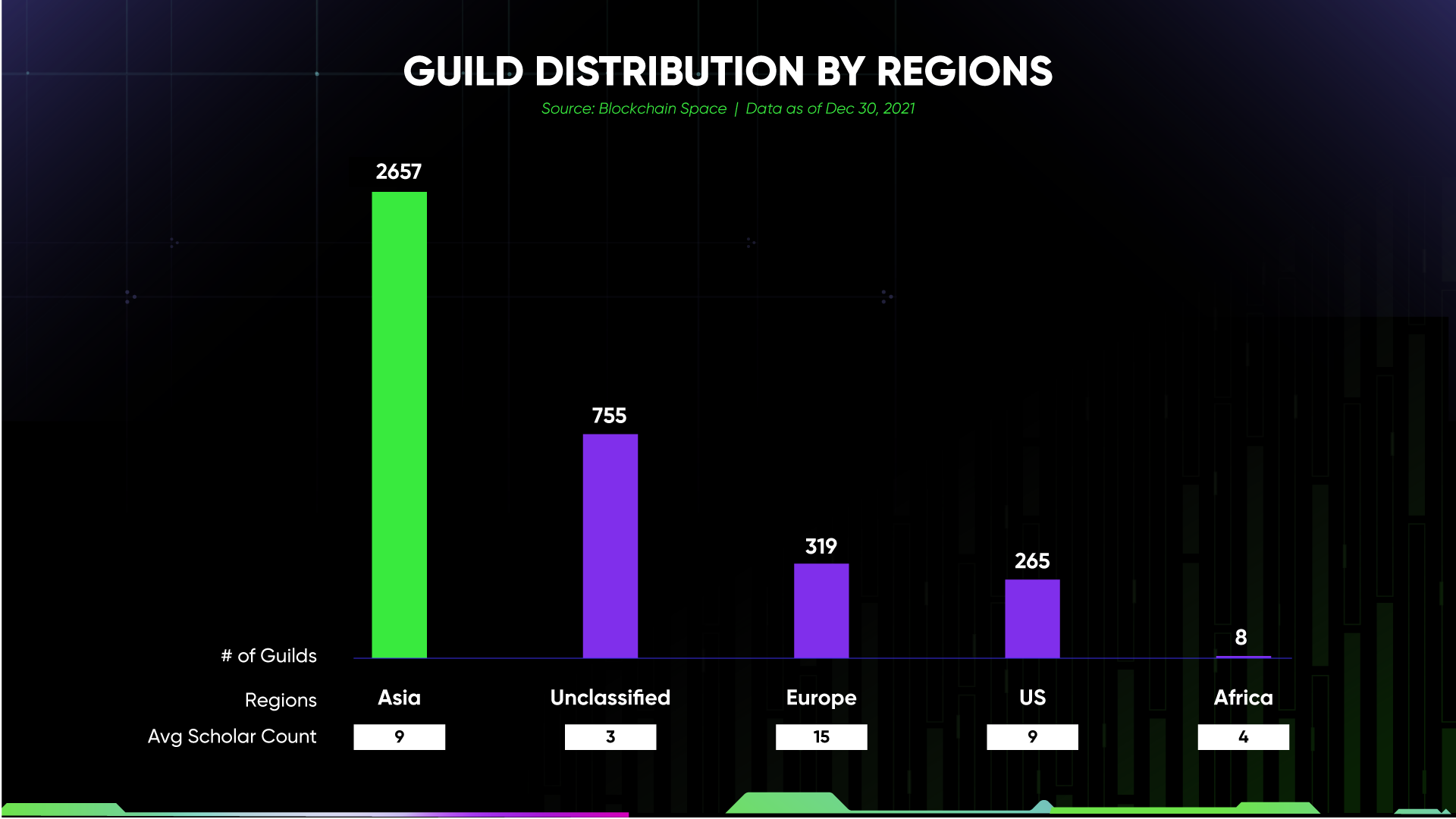

The success of large Guilds popularized this operating model and paved the way for the emergence of small and medium-sized Guilds around the world.

Figure 19: Guild Distribution by Regions

According to Blockchain Space, as of December 29, there were more than 4000 guilds around the world with about 60% based in Asia. The high demand for play-to-earn gaming in Asia is understandable due to relatively low income per capita; there has also been significant growth in the traditional gaming market in Asia as giants like Tencent and Konami gradually increase their market share.

A key selling point of the Guild and Scholarship model is the localization and community orientation. The spirit of collectivism and community-driven patriotism in Asian countries has been key to the success of Guilds in this region, especially South East Asia.

YGG first started in the Philippines, hence the high player base in the Philippines. Ancient8 has successfully claimed the Vietnamese market, while GuildFi dominates in Thailand. Localization and cultural similarities are the bonding agents that every Guild needs to capture their market share of the player base.

Figure 20: SEA Gaming Guild Landscape

Projection for 2022

- Guild as the Community Infrastructure Layer for GameFi

Web3 is built on the foundation of community. Chris Dixon said it best: “ Web3 combines the decentralized, community-governed ethos of Web1 with the advanced, modern functionality of Web2. Web3 is the internet owned by the builders and users, orchestrated with tokens”.

In other words, Guild serves as the community infrastructure layer for Web3 and GameFi. It’s a bold and crucial step in the evolution of DAO. Guild is the party on the ground, reaching, educating, and strengthening the community as it sits between thousands of GameFi projects and millions of Blockchain gaming aficionados. This is also the noble mission that Ancient8 has been striving for since the very beginning. We, Ancient8, assist the community in distinguishing between signals and noise. For high-quality GameFi projects, we are one of the most significant marketing and distribution partners.

- Guild as the Software Infrastructure Layer for GameFi

Given guilds’ direct access to both games, gamers, and the community, the most innovative guilds have always planned to become the software infrastructure layer for GameFi. This includes player management systems, lending platforms, token and NFT launchpads, Decentralized Identity platforms, and more.

Ancient8 has built an internal guild scholar management tool where our scholars can track their progress and development. In the future, this tool will be improved to deliver the best experience and open for other users to offer Guild-as-a-Service (GaaS) to the market. We’ve also spent a lot of time researching and developing additional blockchain and software products that help games to better reach gamers, and help gamers to more easily navigate the rapidly-growing GameFi space. More news to come on this front!

Recap and Predictions

Recap

Blockchain gaming isn’t a new concept but it has received significant attention recently because of the rise of Axie Infinity and the Play-to-earn model.

A considerable number of GameFi projects have been developed and an impressive amount of capital has been invested into this sector from both venture capital and retail investors. Big players in the traditional investment space are starting to take notice as well.

Much work is being done in the blockchain gaming sector to provide scaling solutions that will facilitate the expansion of the space. To that end, many GameFi projects are being developed on “alternative Layer 1” blockchains such as Avalanche, Solana, WAX, Efinity, FLOW, and ImmutableX. New business models and fundraising vehicles have been introduced such as launchpads, IGOs, and gaming guilds to bring GameFi to the masses.

Opportunities and threats

GameFi is not a temporary trend. Rather, it is a perfectly disruptive use case for blockchain technology to empower players. Blockchain technology allows players to truly own their in-game assets, birthing a brand new form of the digital economy.

The global gaming market is massive. According to Newzoo, the gaming industry is valued at $180 Billion. Blockchain games have the opportunity to become a big part of this market by creating a new way to play games and earn while having fun. Crypto VCs are quite open-minded, so it isn’t hard for game developers to raise funding to actualize their ideas.

However, the blockchain gaming industry is currently still in its infancy. Earning remains the essential motivator for users to spend time playing blockchain games, rather than the gameplay itself. Games in which earning is at the core will encounter sustainability problems. If new players can’t earn a profit, the game will experience a downturn. Therefore, for sustainable growth, enjoyable gameplay should be the core focus.

Prediction

In the short term, earnings-focused games will still be dominant in the blockchain gaming space. The financial incentive is a magnet that will attract more players to explore the incorporation of blockchain technology in gaming. This is the essential transition to convert games and players to a whole new space; GameMarketCap calls this the financialization of games. Because of these financial incentives, gaming guilds and related models will see strong growth in 2022.

In the medium term, we will witness the growth of GameFi both in terms of quantity and quality when the extensive amount of capital raised starts producing results.

In terms of quantity, the number of GameFi projects across ecosystems, especially high-performance and GameFi/NFT dedicated blockchains, will expand immensely. As a result, there will be better tools and development kits allowing producers to efficiently develop blockchain games and concentrate on maturing new gameplay ideas without having to spend time building the underlying infrastructure layer. With high processing speed and low transaction costs, there will be more games with more diverse gameplay inspired by traditional games, typically MOBA games, drawing more traditional gamers into the blockchain space.

In terms of quality, reputable GameFi projects in the blockchain gaming space such as Axie Infinity, The SandBox, Radio Caca are pushing upgrades in gameplay that will be ready to launch in the near future. Specifically, Axie Infinity will launch a virtual land system called Lunacia, promising to stir up the GameFi market once again with expansions in gameplay and the Dapp ecosystem.

Crucially, AAA games remain the core activator to unlock the mass adoption of blockchain games and outperform the traditional gaming market. If blockchain games are currently attracting users for the “earn” factor, AAA blockchain games will provide the level-up in the “play” factor. This is the most significant obstacle preventing blockchain games from outperforming traditional games at this stage. This sector, therefore, will be a new battleground for developers, VCs, and even blockchains. With a massive amount of capital raised in 2021 to invest in both the infrastructure for AAA games and the games themselves, the blockchain gaming space has enough evidence to expect an explosion powered by AAA games in the future.

There’s no telling what this industry will look like in the long term, but there will surely be new creative models beyond the P2E mechanics currently applied in blockchain gaming. We at Ancient8 are looking forward to contributing to that future.